are assisted living expenses tax deductible in 2019

Medical expenses generally make up at least a portion of the monthly service fees and entrance fees at assisted living communities. Qualifying medical expenses that make up more than 75 of the residents adjusted gross income can be deducted.

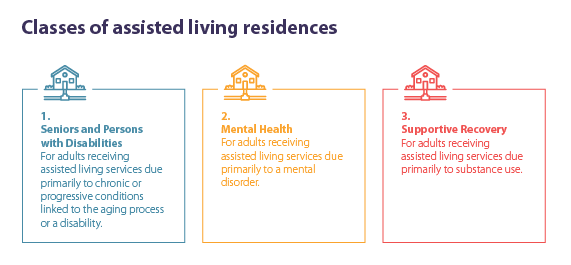

About Assisted Living Province Of British Columbia

You can include the cost of medical care and nursing care cost of meals and lodging in the catered living if the primary reason for being there is to get medical care.

. Some senior living expenses including medical expenses and assisted living expenses are tax-deductible within certain parameters. Simply add up the annual cost of. If that individual is in a home primarily for non-medical reasons then only the cost of.

As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill This means a doctor or nurse has certified that the resident either. Generally a taxpayer can deduct the medical care expenses of his or her parent if the taxpayer provides more than 50 of the parents support costs For some Assisted Living residents the entire monthly.

To return to Moms and Dads situation above they have 48600 of medical expenses the assisted living facility costs and the unreimbursed drug expenses. If Dad figures adjusted gross income of say 90000 then he can deduct the expenses over 75 of 90000 6750. For elders who live in assisted living communities part or all their assisted living expenses might qualify for a tax deduction.

See the following from IRS Publication 502. Yes in certain instances nursing home expenses are deductible medical expenses. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction.

Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. In fact you may be able to deduct a portion of what you pay for assisted living costs. You can deduct assisted living expenses if you or your spouse is a qualified individual.

Deductible Assisted Living Facility Costs. However it depends on what that amount includes and why an individual is in catered living. Which means a doctor or nurse with diagnosing abilities has stated that the patient cant perform at least two daily necessities for their self-care cleaning themselves using the toilet alone.

If their long-term care expenses are more than 10 of your gross income as of 2019 and they are considered chronically ill these expenses are tax deductible. June 4 2019 148 PM. Additionally long-term care services and other unreimbursed medical expenses must exceed 75 of the taxpayers adjusted gross income.

Physical factors of chronic illness include the inability to feed themselves dress bathe or get to the bathroom. According to the IRS any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted from taxes. Mental factors include requiring supervision for their protection.

As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible. Chronic Illness and Tax Deductible Status. If you your spouse or your dependent is in a nursing home primarily for medical care then the entire nursing home cost including meals and lodging is deductible as a medical expense.

Its important to note that each financial situation is unique and personal and that a tax advisor can help you sort through your own taxes to uncover deductions that may apply to you. A TurboTax QA meanwhile explains that assisted living expenses are tax deductible when the patient cant care for themselves as certified by a licensed healthcare practitioner. Simply add up the annual cost of assisted living subtract 10 of your gross income and the remaining balance is completely tax deductible.

This deduction can be taken on your federal income taxes. Tax deductions are available to anyone in assisted living who has been diagnosed as chronically ill. The IRS considers assisted living to be a medical expense and as such it is eligible for the medical expense deduction.

Can You Write Off Assisted Living On Your Taxes. Certain conditions that must be met to qualify. Yes the payments are deductible under medical expenses.

In order for assisted living expenses to be tax deductible the resident has to be considered. Medical expenses including some long-term care expenses are deductible if they exceed 10 of your gross income in 2019. The medical deduction for assisted living includes all the expenses if the primary reason for living in a facility is for medical care.

What Are the Qualifying Criteria for Assisted Living Tax Deductions. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income.

1 Best answer. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill. In 2019 this threshold will be 10 percent To qualify for the deduction personal care services must be provided according to a plan of care prescribed by a licensed health care provider.

Yes assisted living expenses are tax-deductible. Yes if you live in an assisted living facility you can generally write off a number of medical expenses included in the fees for assisted living as well as other qualified long-term care services on your taxeswith some qualifications and restrictions of course. June 1 2019 707 AM.

Medical Expense Tax Credit Nursing Homes Vs Retirement Homes

Tax Tip Can I Claim Nursing Home Expenses As A Medical Expense 2022 Turbotax Canada Tips

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Claiming Attendant Home Care Expenses All About Seniors

Claim Cra Allowable Medical Expenses In Canada Homeequity Bank

![]()

Cra Medical Expenses Guide Brian Petersen Group

What Kind Of Medical Expenses Are Tax Deductible In Canada

Startup Budget Templates 7 Free Printable Word Excel Pdf Budget Template Event Planning Template Budgeting

Medical Expenses Often Overlooked As Tax Deductions Cbc News

Tax Accountant Resume Example Template Nanica Architect Resume Sample Resume Examples Architect Resume

Claim Cra Allowable Medical Expenses In Canada Homeequity Bank

Medical Expense Tax Credit Nursing Homes Vs Retirement Homes